Accounts Receivable in Santa Monica, CA

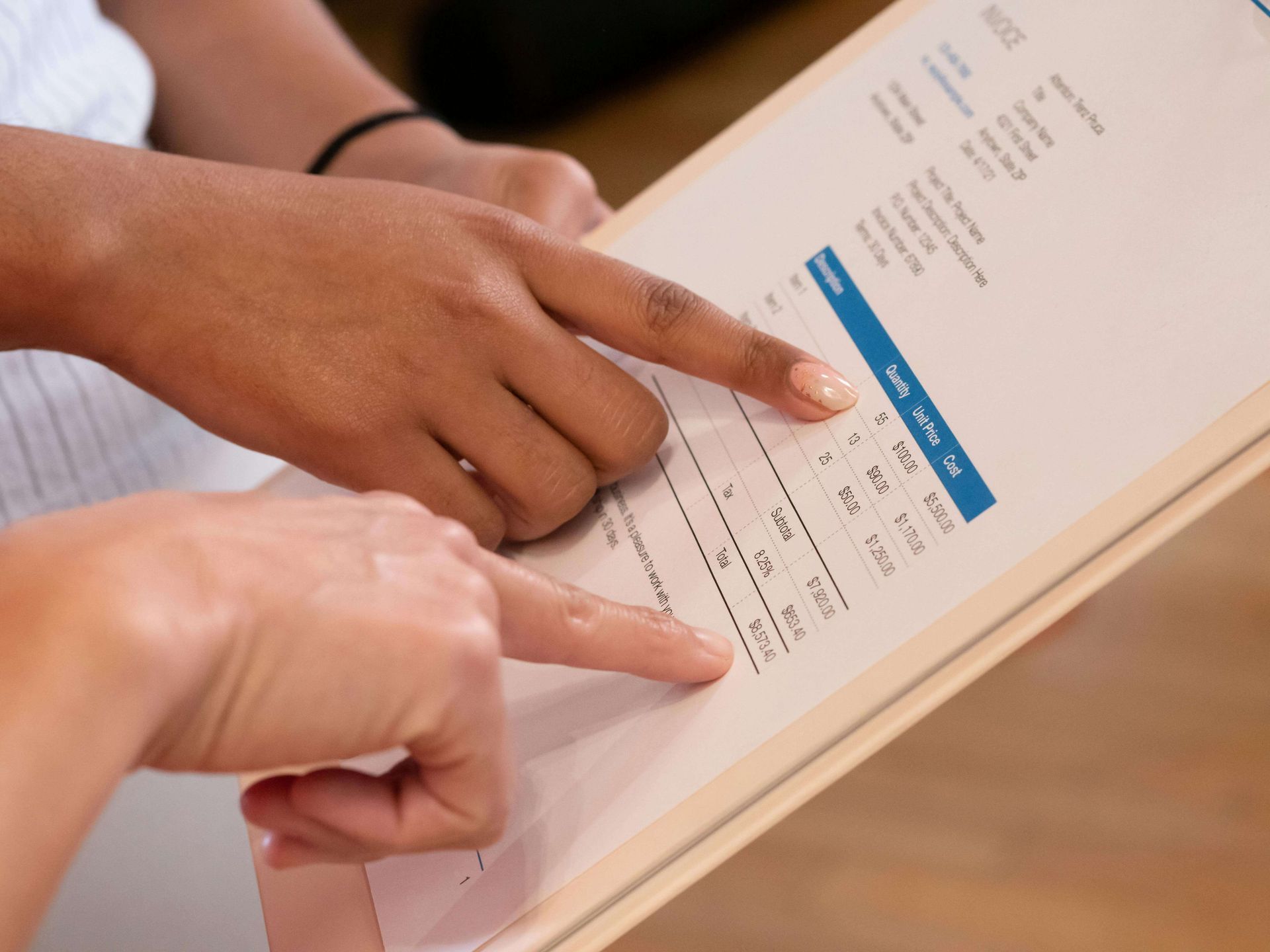

With our A/R services, you can see better profits thanks to our efficient collections, quick invoicing, and careful management of all your financial accounts. We're experts in this area, so we'll make sure your receivables are tracked and managed flawlessly, making your financial operations run smoother overall.

(424)-229-1792

List of Services

-

Recording customer payments, including checks, cash, and credit card transactions. Write a description for this list item and include information that will interest site visitors. For example, you may want to describe a team member's experience, what makes a product special, or a unique service that you offer.

List Item 2 -

Creating and sending invoices using QuickBooks Online. Write a description for this list item and include information that will interest site visitors. For example, you may want to describe a team member's experience, what makes a product special, or a unique service that you offer.

List Item 1 -

Managing A/R reconciliations, undeposited funds, and journal entries. Write a description for this list item and include information that will interest site visitors. For example, you may want to describe a team member's experience, what makes a product special, or a unique service that you offer.

List Item 3 -

Monthly preparation and posting of A/R journal entries. Write a description for this list item and include information that will interest site visitors. For example, you may want to describe a team member's experience, what makes a product special, or a unique service that you offer.

List Item 4 -

Reviewing revenue classifications. Write a description for this list item and include information that will interest site visitors. For example, you may want to describe a team member's experience, what makes a product special, or a unique service that you offer.

List of Services

-

Regularly analyzing financial records and conducting necessary A/R procedures. Write a description for this list item and include information that will interest site visitors. For example, you may want to describe a team member's experience, what makes a product special, or a unique service that you offer.

List Item 1 -

Improving collections by keeping track of open invoices. Write a description for this list item and include information that will interest site visitors. For example, you may want to describe a team member's experience, what makes a product special, or a unique service that you offer.

List Item 2 -

Periodically reviewing any open invoices to ensure accurate A/R aging reports. Write a description for this list item and include information that will interest site visitors. For example, you may want to describe a team member's experience, what makes a product special, or a unique service that you offer.

List Item 3 -

Sending invoices as often as needed. Write a description for this list item and include information that will interest site visitors. For example, you may want to describe a team member's experience, what makes a product special, or a unique service that you offer.

WORKING TOGETHER

What our A/R Services Can Do For You

01

Increase Cash Flow

Businesses thrives on positive cash flow, and we make it our priority to ensure your payments are always on time.

02

Empower Your Decisions

We deliver frequent reports on essential A/R metrics, such as aging and collection performance, providing you with the insights needed to make informed decisions.

03

05

More Time to Focus on Earning “More Time To Make Money”

By managing your accounts receivable, we free up your valuable time so you can focus on the aspects of your business that

only you can.

Keep A/R Management Simple

We handle everything from invoicing to collections and reporting, eliminating the stress of managing your accounts receivable.

04

How You’ll Benefit:

Your business’s success depends on effectively managing A/R turnover, closing out invoices, and maintaining positive cash flows. Our Accounts Receivable service simplifies the entire A/R process. We handle your invoicing, payment processing, and reporting, ensuring everything is done accurately and on time, every time.

What Is The Importance of Accounts Receivable for Businesses?

Accounts receivable (A/R) management is necessary for maintaining healthy cash flow for your business while ensuring its financial stability. As bookkeepers, we often see how effective A/R management is and how it can significantly impact a company's bottom line/operational efficiency.

Firstly, AR represents the money owed to a business by its customers/clients for any goods or services delivered but not yet paid for. It’s vital to collect these receivable as soon as possible after delivering because delayed payments can create cash flow problems. This can hinder the business's ability to pay its own bills, invest in more growth opportunities, and can even hinder the ability to meet payroll obligations. By actively managing A/R, you can ensure that funds are collected promptly and maintain a steady stream of income that supports the business’s daily operations.

Additionally, efficient accounts receivable management aids in building and maintaining good customer/client relationships. Clear and consistent invoicing habits, in addition to regular follow-ups, communicate both professionalism and reliability to clients. If ou struggle to send invoices promptly, ask yourself, why should your client find it necessary to pay the invoice urgently? Your A/R process directly impacts your clients’ view of your business and effects how quickly they make their payments. When customers understand your payment terms and are reminded of their obligations promptly, they’re more likely to pay on time. This not only improves your business’s cash flow but also reduces the risk of bad debts.

Another crucial aspect is the impact on your business’s financial reporting. Accurate AR records contribute to clear-cut financial statements. This in turn provides a clear picture of your business’s financial position. Which is essential for making enlightened business decisions, securing financing, and planning for your business’s future. Investors and lenders often analyze A/R to assess both a business’s creditworthiness and operational efficiency.

Moreover, AR management can affirm trends and insights about customer/client behavior. By analyzing your receivables, you can identify late-paying clients and take the necessary steps to address the issue. Which, for example, could be adjusting credit terms or offering your clients incentives for early payments.

To summarize, efficient A/R management is fundamental to ensuring robust cash flow, maintaining powerful client relationships, generating accurate financial reports, and gaining valuable insights into your business. As bookkeepers, we cannot emphasize enough the importance of having a well-structured, well-maintained, and proactive approach to managing your receivables. Which will ultimately supports the long-term sustainability and success of your business.